BNZ Text Scam – What You Need To Know

BNZ Text Scam – Have you received a text message from BNZ recently? Beware, as it could be part of a sophisticated scam targeting Bank of New Zealand customers.

Scammers are impersonating reputable organisations like Waka Kotahi and NZ Post to deceive unsuspecting customers into providing personal information.

Many individuals and businesses have already fallen victim to this fraud, resulting in significant financial losses and emotional distress.

One victim clicked on a link in the fraudulent text, thinking his account was frozen due to his spending in Australia. Within minutes, $35,000 was withdrawn from his account.

To protect yourself from this scam, verify the authenticity of any messages you receive, avoid clicking on suspicious links, and report any scam texts to your bank and CERT NZ.

Stay vigilant and keep your personal information safe from these fraudsters.

How the BNZ Text Scam Works

So, you’re probably wondering how exactly this BNZ text scam works, right? Well, let’s break it down.

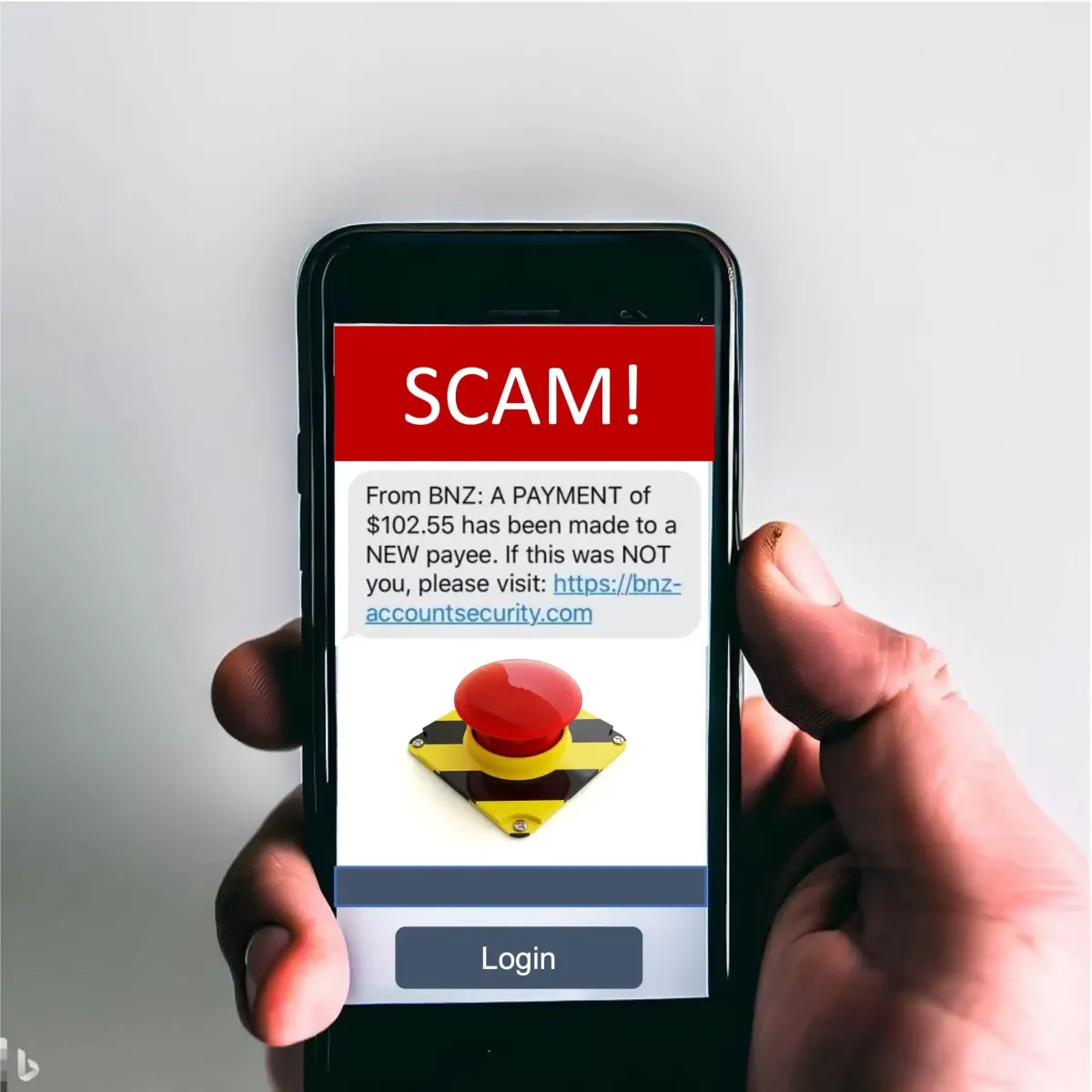

It all starts with a text message that appears to be from BNZ or another legitimate organisation like Waka Kotahi or NZ Post. These scammers are getting smarter and more sophisticated every day.

The message will usually ask you to click on a link or provide your personal information such as internet banking login details, credit card information, or even your driver’s license number. This is what we call phishing scams – they’re trying to trick you into giving away sensitive information.

Once you click on that link or enter your details, the scammers can access your account and withdraw money within minutes.

It’s important to stay vigilant and practice cyber awareness when it comes to these kinds of scams. Remember, never give out personal information over text messages or unfamiliar websites. If something seems fishy, always contact the organisation directly to verify its authenticity.

Signs of a Fraudulent Text Message

Beware of suspicious text messages that exhibit poor grammar and impersonate well-known organisations – these are red flags indicating potential fraud. Pay close attention to the language used in the text messages. Scammers often make spelling and grammar mistakes that legitimate organisations wouldn’t.

Another sign of a fraudulent text is if it asks for your personal information such as internet banking login details, credit card information, driver’s license, or any other sensitive data.

Legitimate organisations would never ask for such information through a text message. Be cautious before clicking on any links in the text messages, as they may lead to fake websites designed to steal your information. If you have already provided personal details or paid money due to a scam, contact your bank immediately.

It’s essential to educate vulnerable individuals about these SMS scams and report any suspicious texts to CERT NZ. Stay vigilant and protect yourself from falling victim to these scams.

Steps to Protect Yourself from the Scam

Take proactive measures to safeguard your personal and financial well-being by following these essential steps in protecting yourself from falling victim to this deceitful scheme.

First, be cautious of any unexpected text messages asking for personal or financial information. Legitimate organisations will never request such details through text messages.

Second, carefully examine the message for any spelling or grammar mistakes, as scammers often make these errors.

Third, avoid clicking on any links provided in the message, as they may lead you to fake websites designed to steal your information.

Fourth, contact the organisation directly using their official contact information to verify the authenticity of the message.

Finally, educate yourself and vulnerable individuals about SMS scams and remind them not to provide personal information unless it is confirmed through trusted channels.

By following these steps, you can protect yourself from becoming a victim of this dangerous BNZ text scam.

Reporting the Scam to BNZ

To report the fraudulent activity, reach out to BNZ and provide them with all the necessary details. Contact their customer service hotline or visit a branch nearest to you. Explain that you’ve fallen victim to a text scam and provide specific information such as the date and time you received the message, the content of the message, any links or websites you interacted with, and any personal information you may have disclosed.

It’s important to act quickly in reporting the scam so that BNZ can initiate their fraud investigation promptly. Remember to also inform them if any money’s already been withdrawn from your account.

By reporting this incident to BNZ, you’re not only protecting yourself but also helping them take appropriate measures to prevent further scams from occurring.

Frequently Asked Questions

What are some common reasons why people fall for the BNZ text scam?

People often fall for the BNZ text scam due to a sense of urgency created by the scammers, believing their accounts are frozen or compromised. They may also be tricked by realistic-looking fake websites and trust in the legitimacy of the message.

How can scammers withdraw money from someone’s account within minutes?

Scammers can withdraw money from someone’s account within minutes by gaining access to their online banking credentials through phishing techniques. They trick individuals into providing their login details, allowing scammers to quickly transfer funds out of the account undetected.

What are the immediate steps someone should take if they realize they have fallen for the scam?

If you realize you’ve fallen for a scam, the immediate steps to take are: contact your bank to freeze your accounts, change your passwords, report the scam to the police and relevant authorities, and monitor your accounts for any further suspicious activity.

Are there any long-term consequences for individuals who have been scammed?

Long-term consequences for scam victims can be significant. They may suffer financial loss, damage to their credit score, and emotional distress. Rebuilding trust and recovering financially can take time. It’s crucial to report the scam, monitor accounts, and seek support from authorities and banks.

How can individuals educate vulnerable individuals about SMS scams and help prevent them from falling for these scams?

Educate vulnerable individuals about SMS scams by raising awareness of common scam tactics and warning signs. Teach them to verify messages directly with organisations, avoid clicking suspicious links, and never share personal information.